LIQUIDITY PROTECTION RULE

The purpose of the CODA Liquidity Protection Rule1 (LPR) is to prevent a CODA Fuse or CODA Block auction from moving a stock’s price an unreasonable distance based on the size of the print and the liquidity profile of the stock. The rule is driven by an equation that is calibrated individually for every stock based on the pattern of its trades over the last 20 trading days. The calibration methodology is designed to reflect the typical price variance of each stock as a function of its notional turnover. The LPR takes the size of a CODA print as an input and returns the maximum distance the CODA engine will allow the auction to go up outside the NBBO as the output.

Trade Data Filtering

The calibration acts on all regular way trades reported to the SIP during regular market hours, exclusive of opening and closing auction volume as well as other trades that appear to be reported out of sequence or are otherwise unrelated to the prevailing market conditions.

Data Point Generation

For every trade, 5 windows are randomly created spanning sequential trades summing to a notional value of $100K – $250 MM. The price variation of the trades in the window is measured, creating a large set of (window size, price variance) data point pairs.

Regression Calibration

All data point pairs spanning the most recent 20 trading days are aggregated and organized into bins of similar notional value. A regression runs upon the median price variance for each notional bin to generate an equation that characterizes price variance as a function of notional turnover.

Optimizations

Several rules are applied to ensure that the results don’t offend our common sense, including but not limited to: a. Enforce monotonicity the equation curve is flattened out if necessary to guarantee that it never has as a negative slope, i.e., it never gives a smaller answer for a larger number of shares b. Not enough data – if a symbol does not trade enough to generate a statistically significant number of data points. We default to logic that hardcodes the LPR value at twice the average daily range of the stock, regardless of auction size. In such stocks, the minimum CODA auction size is large relative to the stock’s ADV so a more granular determination of a reasonable distance to move the stock’s price cannot be made.

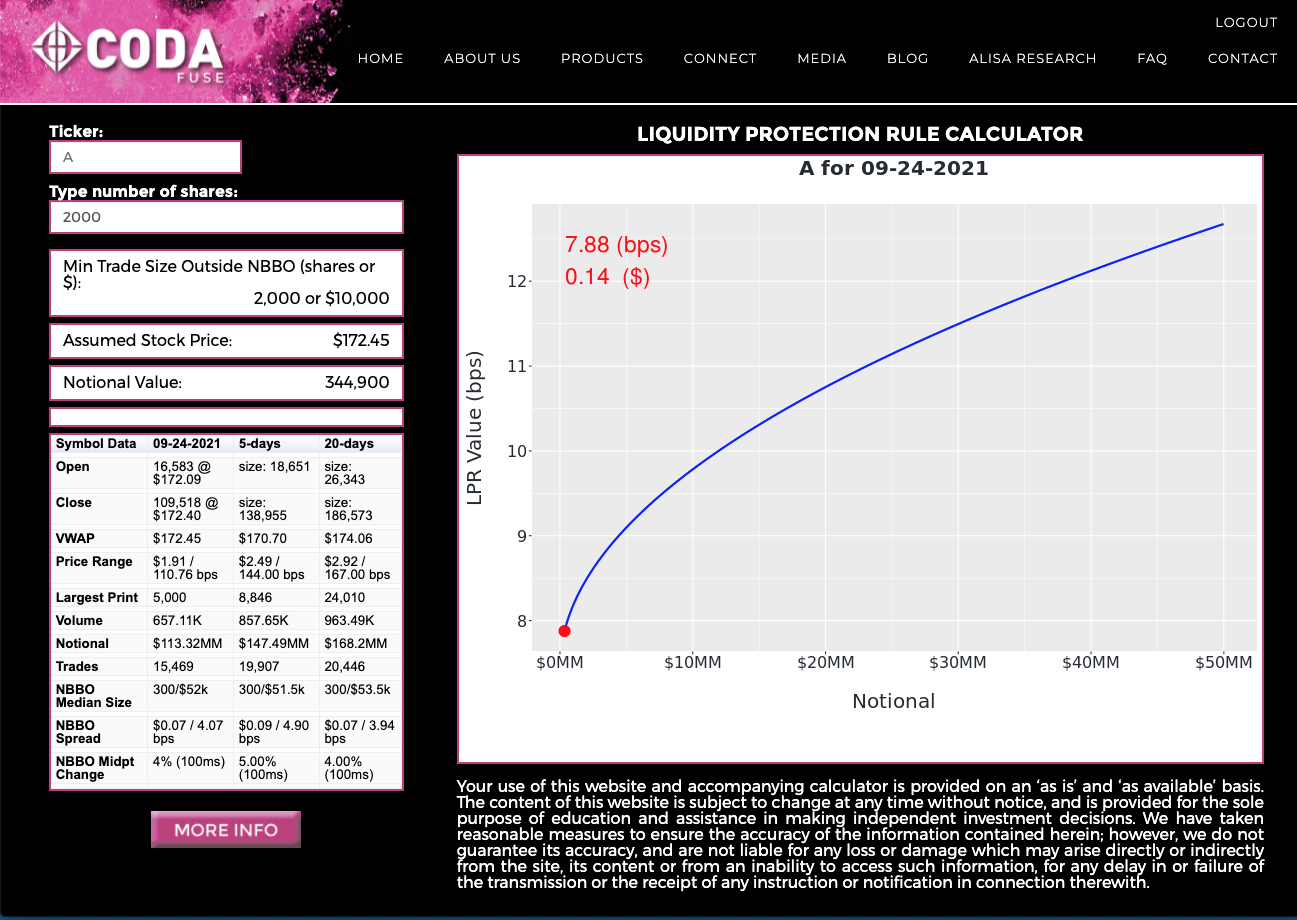

In this example, a trader has queried the Liquidity Protection Rule value for 2,000 shares of symbol A. Based on an analysis of all trades in A over the last 20 days, the LPR Calculator has returned that the maximum distance outside the NBBO that the LPR will allow CODA to print 2,000 shares of A is 3.76 basis points or $0.07.

Open: Price and size of opening print from primary market for prior trading day; 5 and 20 days averages of size only.

Close: Price and size of closing print from primary market for prior trading day; 5 and 20 days averages of size only.

VWAP: Volume Weighted Average Price of regular way trades during regular market hours (exclusive of opening & closing volume).

NBBO Median: Typical size found on one side of the NBBO. Calculator as follows: all exchange quotes are aggregated and the total size (bid size + offer size at the NBBO). The median value is divided by two and reported in shares and notional terms.

NBBO Spread: Typical NBBO spread width. Calculated as follows: all exchanges quotes are aggregated and the NBBO spread width is calculated for each unique state of the NBBO. The median value is reported in dollar and notional terms.

NBBO Midpt Change: Likelihood the NBBO midpoint will change in a random 100ms window of time. Calculated by dividing the trading day into 100ms segmented and counting what % of them contains NBBO midpoint change.

1 The Liquidity Protection Rule is the result of data analysis

Performed by ALISA (Advanced Liquidity Studies and Analytics), a data platform operated by Apex Fintech Solutions.

Fill out the form below to get connected to our team.